Unlock Your Prospective with Expert Loan Services

Unlock Your Prospective with Expert Loan Services

Blog Article

Accessibility Flexible Loan Providers Designed to Fit Your Unique Situation

In today's vibrant financial landscape, the value of accessing adaptable funding services customized to private conditions can not be overemphasized. What precisely makes these versatile lending services stand out, and exactly how can they absolutely provide to your ever-evolving economic demands?

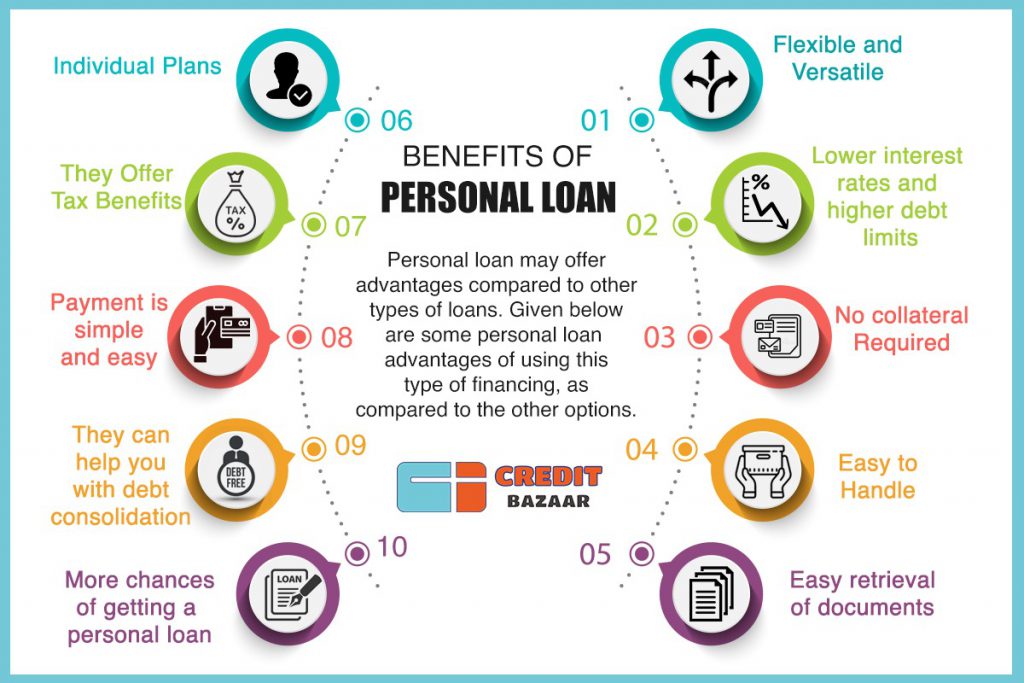

Advantages of Flexible Loan Provider

Adaptable loan services supply customers the benefit of customizing settlement terms to match their economic circumstances and goals. This level of modification provides a series of advantages to customers. Firstly, it permits people to choose a repayment schedule that lines up with their revenue regularity, whether it be weekly, bi-weekly, or monthly. This adaptability makes certain that customers can comfortably manage their repayments without experiencing financial pressure. Second of all, debtors can pick in between set or variable rate of interest based upon their threat tolerance and financial approach. This option encourages borrowers to select the most economical service for their particular situation. In addition, flexible financing services typically provide the capacity to make extra repayments or settle the funding early without sustaining charges. This function makes it possible for borrowers to save money on interest expenses and increase their course to debt-free condition. In general, the benefits of flexible car loan solutions offer debtors with the tools they require to effectively manage their finances and attain their long-lasting economic goals.

Comprehending Your Loaning Options

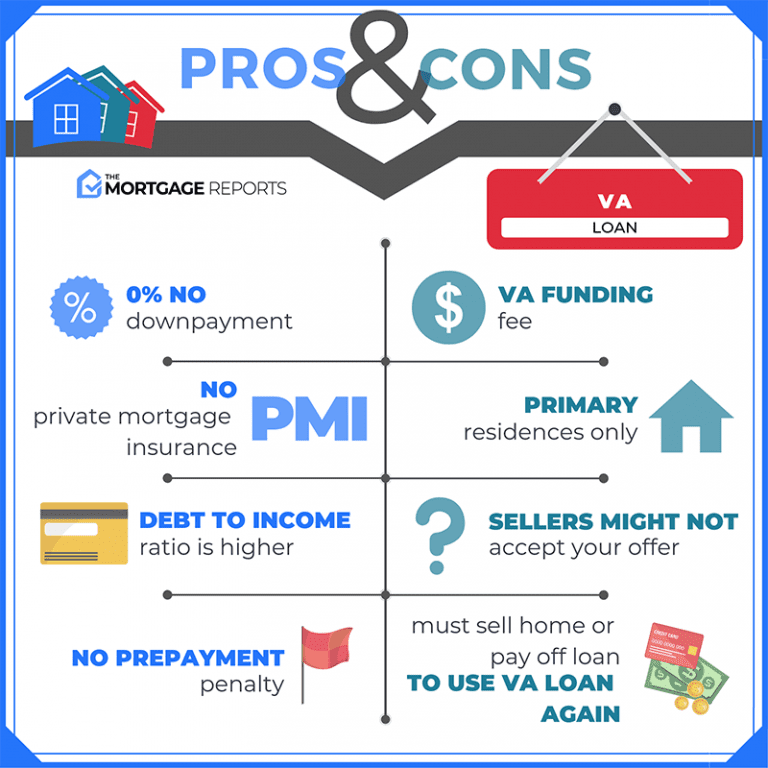

For individuals looking to finance greater education and learning, pupil financings offer a practical alternative with flexible payment strategies. Additionally, individuals with existing homeownership can utilize home equity car loans or lines of credit score to access funds based on the equity in their homes. Comprehending these borrowing choices permits people to make informed decisions based on their monetary objectives and circumstances, making sure that they pick the most appropriate funding item to fulfill their needs.

Tailoring Finance Terms to Your Needs

When borrowers analyze their financial requirements abreast with different financing alternatives, they can tactically personalize funding terms to fit their specific needs. Customizing financing terms entails a thorough analysis of elements such as the wanted financing quantity, payment period, interest prices, and any type of extra fees. By understanding these components, debtors can work out with lenders to develop a lending agreement that straightens with their monetary goals.

Additionally, consumers can work out for versatile terms that permit for adjustments in case of unexpected monetary obstacles. This could include options for repayment deferments, lending extensions, or adjustments to the payment timetable. Ultimately, tailoring funding terms to specific demands can bring about an extra workable and personalized borrowing experience.

Managing Repayment Easily

To make certain a smooth and efficient payment process, customers ought to proactively prepare and organize their monetary management approaches. Furthermore, creating a spending plan that prioritizes funding repayments can help in handling funds successfully.

In cases where consumers experience financial problems, it is crucial to connect with the lender without delay. Numerous lending institutions provide alternatives such as loan restructuring or short-lived payment deferments to aid individuals encountering challenges. mca loans for bad credit. Loan Service. By being transparent regarding financial circumstances, borrowers can work in the direction of equally useful options with the loan provider

Furthermore, it is advantageous to explore possibilities for early settlement if viable. Repaying the funding ahead of schedule can lower general interest expenses and offer economic alleviation over time. By staying aggressive, interacting openly, and exploring settlement methods, customers can properly handle their lending responsibilities and achieve economic security.

Safeguarding Your Financial Future

Safeguarding your financial future is a vital facet of attaining peace of mind and long-term stability. By producing a thorough economic plan, people can establish clear goals, establish a budget plan, conserve for emergency situations, spend intelligently, and protect their assets through insurance coverage.

Additionally, expanding your financial investments can assist alleviate threats and improve general returns - mca loan companies. By spreading out investments throughout different property classes such as supplies, bonds, and property, you can minimize the impact of market changes on your profile. Routinely assessing and adjusting your monetary plan as your circumstances change is just as important to remain on track in the direction of your Home Page objectives

Fundamentally, thorough financial preparation is the foundation for a protected financial future. It offers a roadmap for attaining your objectives, weathering unanticipated difficulties, and eventually enjoying financial stability and satisfaction in the years to come.

Final Thought

Finally, versatile lending solutions offer a variety of advantages for borrowers, supplying customized choices to suit specific monetary situations. By comprehending loaning options and tailoring lending terms, people can conveniently manage settlement and protect their monetary future. It is vital to discover these adaptable loan solutions to make certain a positive economic result and attain lasting monetary security.

Report this page